What is TDS Form 16B?

The Buyer, Mr. B, in our case, shall also give a Certificate of TDS deducted in Form 16B to the seller. follow these simple steps

- Login to the TRACES website https://www.tdscpc.gov.in/app/login.xhtml

- Next, got to the Downloads section

- From the list, select Form 16B

- Enter all the details as required, and click on “Go.”

On Which Amount TDS Shall be Deducted for the Sale of the Property Covered u/s 194IA?

TDS under Section 194IA needs to be deducted on the consideration, sale value or stamp duty value and not on the value inclusive of applicable taxes. Say the property is sold at Rs. 60,00,000 and GST is applicable on Rs. 6,00,000. In this case the TDS u/s 194IA would be deducted on Rs. 60,00,000 and not on Rs. 66,00,000.

TDS was brought to introduced to keep a track of transactions related to the sale and purchase in the real estate sector. This was done because it is a highly speculative market where transactions are done partly in cash and partly through banking channels. This change will also assist the government in clearly recognizing instances in which a property is purchased for less than its stamp value.

If you are the seller who has deducted TDS, you need to file a TDS return. The deductors should file a TDS return on time to avoid penalties. Tax2win’s tax experts can help you file TDS returns accurately and ensure a smooth tax filing journey.

Frequently Asked Questions

Q– I forgot to deduct TDS when I purchased a property. What should I do now?

Taxpayers will be liable to pay Interest @1% as the case may be and a penalty which may extend to Rs.100000/- under section 271H.

| Condition | Penalty |

|---|---|

| Non-deduction of TDS | Penalty of 1% interest on the amount not deducted for TDS |

| Non-remittance of TDS to the government | Penalty of 1.5% of the deducted amount per month |

| Delay in filing of TDS returns | Penalty of Rs. 200 per day for each day of default |

Q– How can I get Form 26QB online?

It can be generated by logging into the Traces site.

Q– Who has to pay TDS on the sale of the property?

The buyer has to deduct TDS on payment of consideration to the seller.

Q– Should I deduct TDS on the amount exceeding the property value of Rs 50 lakh or the entire amount at which I have bought the property?

TDS on the entire amount of consideration or the stamp duty value, whichever is higher, if property value exceeds Rs. 50 lakh.

Q– How do I procure TAN to report the TDS on the sale of property?

Neither the buyer, nor the seller is required to procure the TAN for making TDS payment on the purchase of immovable property.

Q– What should I do if I don’t have the PAN of the seller(s)?

The seller(s)’s PAN is mandatory for deducting TDS and filing Form 26QB. You are required to take the seller’s PAN beforehand.

Q– How can I use the Form 26QB facility to pay TDS on the purchase of property?

Visit NSDL site , then choose TDS on sale of property. After that fill all the details, make payment and take a print of Form 26QB generated and submitted to the bank.

Q– Can I amend form 26 QB?

Yes, corrections under 26QB are possible. to understand in detail, click here

Q– What is the date of deduction in Form 26QB?

The date of deduction refers to the date on which TDS has been deducted by the buyer. Please click https://taxinno.com/income-tax-returns-services/tds-return-filing/

When and How Much Shall be the TDS on the Sale of the Property?

TDS is to be deducted from the stamp duty value of the property if it is more than the sale value. Also, if the value of the property exceeds Rs.50 lakhs, the TDS is deducted on the entire amount and not just on the amount over and above Rs.50 lakhs. For example, if Mr. B purchased a property from Mr. S for a sum of 60 Lacs, but the stamp duty value of such property is 65 Lacs. In this example, the TDS will be calculated on Rs.65 lakhs and not on Rs.15 lakhs (65,00,000 – 50,00,000). Under the new amendment, a TDS of 1% will be calculated and deducted on a total of 65 Lacs, i.e., 65,000/-, and Mr. B will be paid 59.35 Lacs.

If you find calculating the TDS amount complicated, you can contact our tax experts, who can help you calculate the TDS amount and file TDS returns.

How Deducted Tax Shall be Deposited with the Government in Form 26QB?

The amount of Rs.65,000 (Sixty Thousand) deducted as TDS by Mr. B shall be deposited to the government within 30 days from the end of the month in challan Form 26QB (TDS on Property).

Points to Remember: Purchaser of the Property

- Tax at the flat rate of 1% must be deducted from the sale consideration.

- The purchaser must collect the PAN of the seller to ensure that it is verified.

- The PAN cards of both purchasers and sellers must be there in the online form.

Points to Remember: Seller of the Property

- You must provide your purchaser with the PAN card so that information in regard to the TDS can be furnished to the IT Department.

- You should ensure that the purchaser verifies the taxes that have been deducted in Form 26AS.

In Case of more than 1 buyer or seller

If more than One Buyer or Seller: Challan and Form 26QB will be filled in by all the buyers for respective sellers for their respective shares. For example, in the case of one buyer and two sellers, two challans and Form 26QB have to be filled in, and in the case of two buyers and two sellers, four challans and Form 26QB have to be filled in for the respective property shares, for the application of Section 194-IA total value of the property will consider, not the respective share of the buyer and seller. For e.g. Property is purchased by two buyers/sellers, and the property value is ₹ 80 Lakhs, So the sale consideration respective share of buyer/seller is ₹ 40 Lakhs each (below ₹ 50 Lakhs), but as per rule, total value of the property will consider, so Section 194-IA is applicable.

What is the Process to Make Payment of TDS or Generate Form 26QB Online?

The below process can be used to fill out form 26QB, from generating form 26QB to making payment online.:

- Step 1: Go to the official Income Tax website and log in to your account.

- Step 2: Navigate to the ‘E-file’ section, select ‘e-pay Tax’, and then click the ‘Proceed’ button for ’26QB (TDS on sale of the property)’ in the ‘New payment’ section.

- Step 3: Fill in three pages with the necessary information, including buyer and seller basic details, property details, tax deposit details, the amount credited or paid, address details, and communication/contact details, as well as the residential status of the seller.

- Step 4: On the following page, choose your preferred payment mode: ‘Pay later’ or ‘Pay Now’.

- Step 5: Click on ‘Pay Now’ to proceed with paying the required TDS amount. After payment, the Form 26QB acknowledgment will be generated and can be downloaded.

- Step 6: Once Form 26QB is processed, you can generate the TDS Certificate from the TRACES Portal by logging in as a Tax Payer.

How to Download Form 26QB?

To learn how to download Form 26QB, follow these steps:

- Step 1: Go to the official Income Tax Website and log in. Then select ‘e-file’ followed by ‘e-pay taxes’.

- Step 2: Choose ‘Payment history.’ If Form 26QB has already been filed, you will find an entry under the type of payment labeled ‘TDS on Sale of Property (800)’. Under ‘Action,’ you will see the option to download the receipt or statement of Form 26QB.

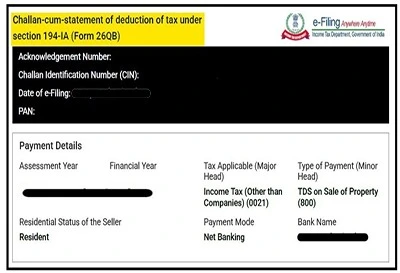

Here’s a sample of Form 26QB for your reference.

Where can the TDS Deducted on the Property be Seen by the Seller?

TDS deducted will reflect in Form 26AS Part F, as shown in the image:

Form 26QB: TDS on Purchase of Immovable Property

Under The Income Tax Act 1961, a few key rules regarding the sale and purchase of immovable property have been laid out. Such transactions are covered under Section 194-IA. The buyer of the property, also known as the deductor, is required to deduct TDS from the consideration payable to the property seller. This is required if the transaction value is more than Rs. 50 lakhs, and the deductor is required to issue Form-16B to the deductee (seller). All such requirements for Form-26QB have been listed under Section 194-IA. So, in this guide, we explore everything that you need to know about form 26QB.

What is Form 26QB?

Any person or HUF purchasing a property valued at least Rs. 50 lakhs must deduct TDS @1% from the stamp duty value or the sum of property, whichever is higher. According to section 194IA of the Income Tax Act, TDS is applicable on the purchase of immovable property. The property here includes every immovable property like –

- House Property

- Commercial Property

- Plot or unconstructed land

And all such other properties except agricultural land. TDS needs to be deducted only on the transactions where sale proceeds are Rs.50,00,000 (Fifty Lakhs) or more.

Here’s a sample of Form 26QB for your reference.

Here’s a sample of Form 26QB for your reference.